And I mean more than simply drilling new wells.

The price of lithium is breaking out! And from here, prices for the energy metal are set to absolutely explode! You will not want to miss out on this opportunity.

Energy is such a pervasive resource that it affects every single human endeavor. Energy has become fundamental to the very basic functions of contemporary civilization. And it is imperative to the future growth, prosperity, social stability, and security of nations around the world. Without energy, everything comes to a grinding halt. Energy and Capital has collected some of the most highly touted energy experts in the industry. These guys literally wrote the book on investing in Peak Oil.

For those of you who can see the buying opportunity right now, I recommend focusing your due diligence right here at home, where the best oil stocks on the planet are drillingright now!

Ultimately, balancing out the supply and demand imbalance is the largest catalyst for this fragile recovery.

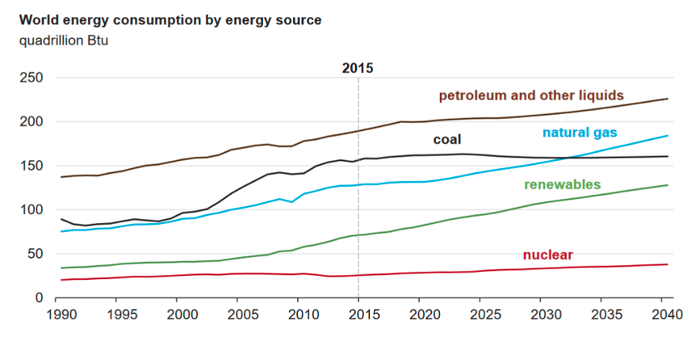

Energy Demand will Increase 58% Over the Next 25 Years

Unfortunately for them, its taking more and more to spook the market these days. It seems as if theres a daily headlinesomewherethat is reporting a new missile launch in North Korea or another outbreak of fighting in the Middle East.

I told my readers recently that the road to recovery will be slow going.

But this isnt the same situation we find ourselves in right now.

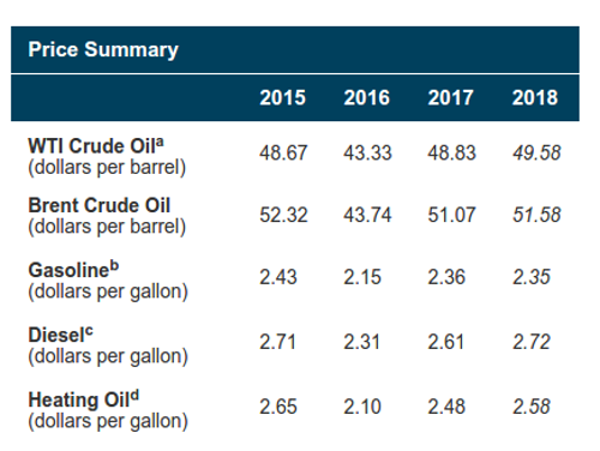

Yet despite the slight price increase expected year over year, the EIAsShort-Term Energy Outlookprojects gasoline prices to remain flat in 2018, averaging just $2.35 per gallon.

I Hit a Tesla This Morning, and I Liked It

Energy and Capital editor Keith Kohl ruminates on the EV market after hitting a Tesla.

Now, I know betting on oil isnt as popular as it was a decade ago. The excitement over theshale boomhas tempered somewhat after prices crashed between the summer of 2014 and February of 2016.

I can remember a time when the mere thought of a supply disruption would send traders into a frenzy.

We never spam!View our Privacy Policy

The Best Free Investment Youll Ever Make

The moment those E&P players in the Lower 48 learn they can bolster their cash flow from higher prices, theyll immediately turn on the taps…

Learn aboutEnergy and Capitaland ourPrivacy Policy

Which industry in California is responsible for the most energy usage?

Thanks for sharing your thoughts! Believe it or not, the marijuana industry uses more energy than any other sector in California. Get the real facts on how massive the legal marijuana industry has become in California as well as the entire country in our comprehensive report An Investors Guide to the Booming Marijuana Industry. Simply enter your e-mail address to receive the report along with our FREE newsletter!

The EIA reported that U.S. oil output in August 2017 averaged 9.2 million barrels per day.

Lithium has been the front-runner in the battery technology market for years, but that is all coming to an end. Elon Musk is against them, but Jeff Bezos is investing heavily in them. Hydrogen Fuel Cells will turn the battery market upside down and weve discovered the tiny company that is going to make it happen.

Are Electric Vehicles Killing Big Oil?

Exclusive Report- Oil Outlook 2018: Long-Lost Recovery or Price Crash?

Remember, Hurricane Harvey knocked out more than a dozen refineries along the U.S. Gulf Coast, including both the largest and second-largest oil refinery in the United States Saudi Aramcos newly acquired Port Arthur and Exxons Baytown facilities, respectively.

After getting your report, youll begin receiving theEnergy and Capitale-Letter, delivered to your inbox daily.

If theres one takeaway that you get today, its this: focus on the fundamentals.

Between 2015 and 2040, the EIA estimates that global energy demand will rise 28% from 575 quadrillion Btu to 736 quadrillion Btu!

Next year, it expects our domestic crude production to jump about 5.4%, averaging 9.8 million barrels per day.

Next year, oil will continue to trend higher as the supply/demand imbalance works itself out.The EIAs current forecast is that WTI prices will increase roughly 1.5%, averaging approximately $49.58 per barrel.

We have hit the sweet spot with Oil and there is no better time to get invested than in 2018. Our Oil Outlook Report for 2018 will help you navigate this profitable sector with ease. Were offering you the report today, FREE of charge. Just tell us where to send it. Youll also have exclusive FREE access to the market insight offered in the Energy and Capital e-mail newsletter, which will help you shape your investment portfolio no matter which way the market swings.

Were in a stock pickers market today, and the field of winners is a lot slimmer than it was in 2009.

And in case you dont think youroil investmentsare worth holding onto, always have this chart as a handy reminder:

Sign up to receive your free report. After signing up, youll begin receiving the Energy and Capital e-letter daily.

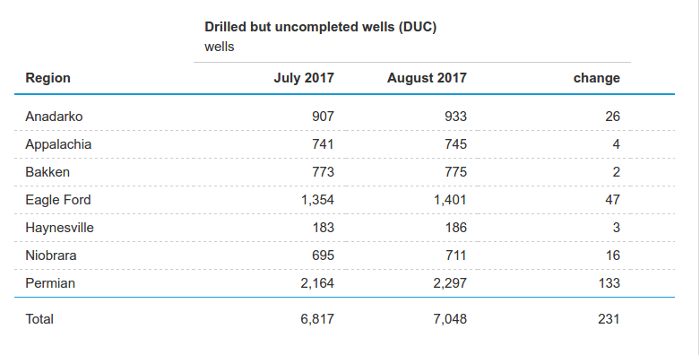

Above, youll find a list of how many drilled but uncompleted wells (DUC) can be found in our largest oil-producing regions.

To learn everything about the battle set to shakeup the battery market and receive more insights from the minds at Energy & Capital, simply enter your e-mail address below. Forward-thinking investors believe this oppotunity will be one for the history books. See why today!

In fact, a sudden price spike is the last thing we want to see happen. Remember, if crude prices rise too high, too soon, all it would accomplish would be a flood of oil coming out of the United States various tight oil plays.

Look, you and I both know there are a myriad of factors that swingcrude pricesone way or another.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join ourEnergy and Capitalinvestment community is sign up for the daily newsletter below.

Just remember to keep your expectations tethered to reality.

Energy and Capital editor Keith Kohl explains why one of OPECs biggest founders has come crashing down recently.

Energy and Capital editor Keith Kohl begins to question whether or not electric vehicles are killing Big Oil.

In August, there were more than 7,000 DUC wells in total. The cash-strapped upstream sector in the oil industry would love nothing more than to complete those wells and sell that crude for a handsome profit on the back of a price spike.

Trillions will be spent to secure the worlds energy supply over the next two decades…and all sources are on the table. Oil, natural gas, solar, wind. There will be money made. Follow the money trail. Sign up for Energy and Capital now – its entirely free!

A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor ofEnergy & Capitalas well as Investment Director of Angel PublishingsEnergy Investor.For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations all ahead of the mainstream media. For more on Keith, go to his editorspage.

The Energy Information Administration (EIA)agrees with me:

Today, it seems like a new natural disaster is springing up daily.

And I dont just mean bad weather; these events have been utterly catastrophic, from back-to-back-to-back-to-back hurricanes (Harvey to Irma to Jose to Maria) to the devastating earthquake in Mexico that has killed over 250 people so far.

You remember those days, right? If you have had any skin in the game, it was quite a nerve-wracking experience especially if you were playing the wrong side.

©2018Energy and Capital.All rights reserved.

In todays low oil price environment, its far more difficult to find the right winner. Unfortunately, it means a lot of the investment herd will lose their shirts betting on the wrong horse.

These terrible events have had an incredible impact on the supply/demand dynamics.

We never spam!View our Privacy PolicyYoull also get our free report,Two Oil Storage Stocks Headed Higher During Glut (Bear Market??)

In 2016, the cost for a barrel ofWestern Texas Immediate (WTI)averaged $43.33. This year, WTI is expected to average $48.83 per barrel.

More importantly, it was far easier to call the bottom back then… and profit from it.

Hey, even I get caught up in the electric vehicle revolution that is just starting to build momentum; its almost impossiblenot togiven the fact that Tesla has officially rolled out its Model 3.

Is it possible that the Middle East turmoil has become white noise? Maybe.

Hydrogen Fuel Cells: The Downfall of Tesla?

Sign up to receive your free report. After signing up, youll begin receiving the Energy and Capital e-letter daily.