We break down the wealthiest countries in the world, which hold a whopping …

The Raw Materials That Fuel the Green Revolution

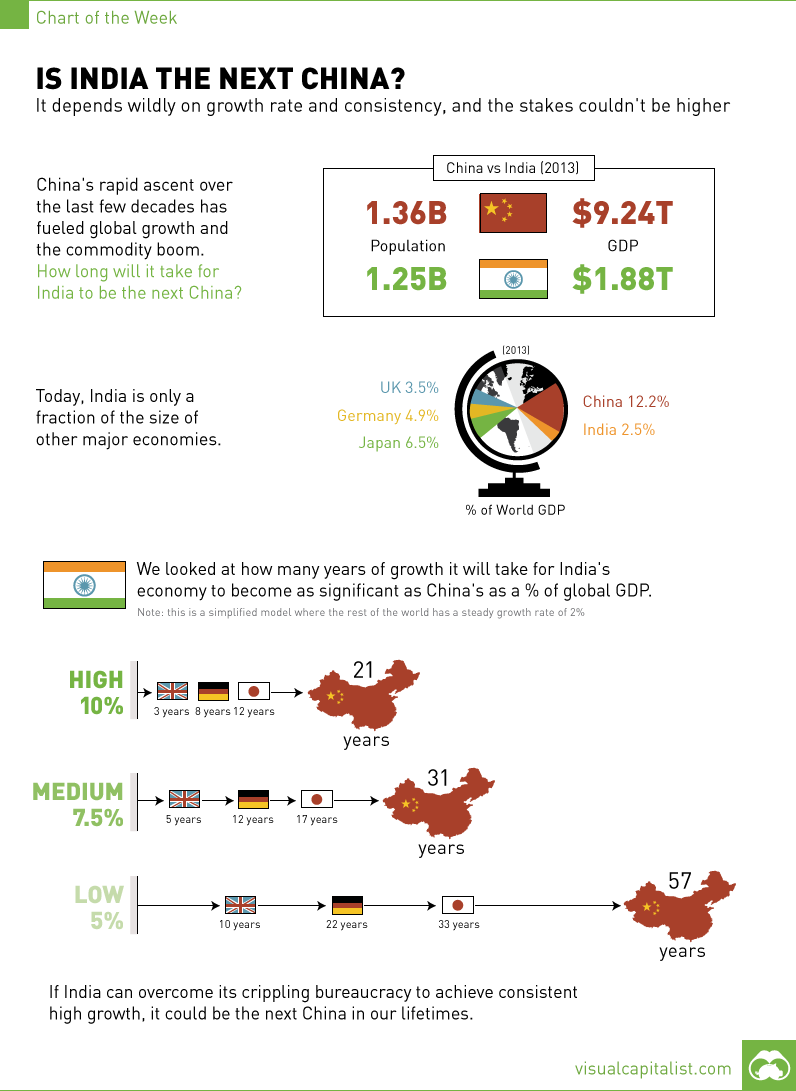

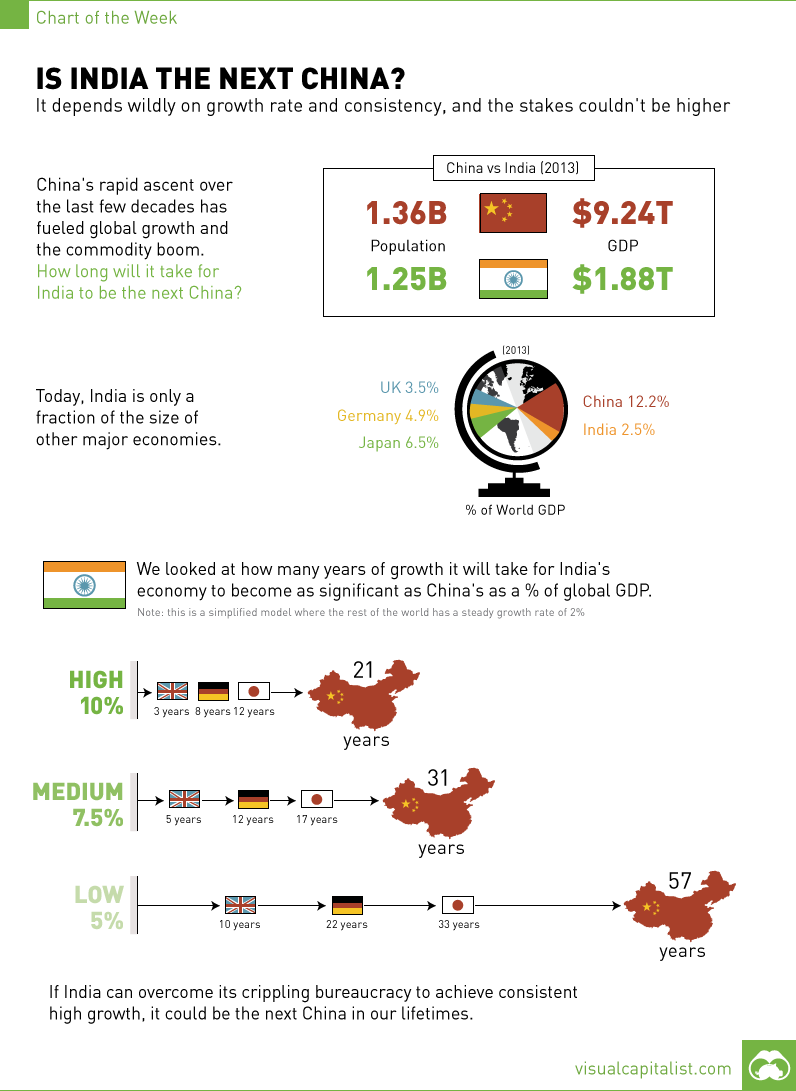

Its no secret that the most recent bull market in commodities and global growth corresponded with the emergence of China on the world stage. When a country with over 1 billion people can grow at 10% for decades at a time, the power of compound interest starts to add up.

The Relationship Between Money and Happiness

The Largest Export of Every U.S. State in 2017

The Rise of the ICO, and What It Could Mean for Venture Capital

Ranked: The Best and Worst State Economies

Interactive: Comparing Asian Powers to the U.S.

Interactive: Comparing Asian Powers to the U.S.

We did some back of the envelope calculations to see at what rate India would have to grow to be as significant to the world economy as China is today. We looked at India growing at high (10%), medium (7.5%), and low (5%) rates over the coming years. Based on this, India wouldnt be comparable to todays China until 21 years, 31 years, or 57 years respectively. (Note: to keep model simple, we had the rest of the world growing at a steady pace of 2%)

We break down the wealthiest countries in the world, which hold a whopping …

Chart: Heres How 5 Tech Giants Make Their Billions

The Most Valuable Brand in Each Country in 2018

Where the Worlds Ultra Rich Population Lives

$63 Trillion of World Debt in One Visualization

The Warren Buffett Empire in One Giant Chart

Yes, its a given that Google dominates the search market – but the fact is…

Walmart Nation: Mapping the Largest Employers in the U.S.

Commodities have kicked off the year as the top performing asset class. Cou…

Chinas Staggering Demand for Commodities

How Different Age Groups View the Trade-Off Between Time and Money

The Remarkable Early Years of Warren Buffett

The Warren Buffett Empire in One Giant Chart

How Tech is Changing the Modern Credit Landscape

Visual Capitalist creates and curates enriched visual content focused on emerging trends in business and investing.

Every Single Cognitive Bias in One Infographic

Ranked: The 10 Wealthiest Countries in the World

The Multi-Billion Dollar Industry That Makes Its Living From Your Data

Map: Economic Might by U.S. Metro Area

Ranked: The 10 Wealthiest Countries in the World

Visualizing the Prolific Plastic Problem in Our Oceans

On the bright side, Brazil may also be a good bridge for global growth. China certainly believes so, and thats why they just announced aninvestment of $50 billioninto the countrys infrastructure projects.

Craft Oil: The Lesser Known Side of Americas Energy Industry

Ranked: The 10 Wealthiest Countries in the World

Which state could be hit hardest by a trade war? Here is every U.S. state o…

The third infographic in our Rise of Tesla Series showcases Musks ambitiou…

Visualizing Elon Musks Vision for the Future of Tesla

Ranked: The Best and Worst State Economies

The traditional credit score is becoming obsolete – and now, big data and n…

This infographic is Part 2 of our Rise of Tesla Series, and it documents t…

The traditional credit score is becoming obsolete – and now, big data and n…

The Jeff Bezos Empire in One Giant Chart

Teslas Journey: From IPO to Passing Ford in Value, in Just 7 Years

TheChart of the Weekis a weekly feature in Visual Capitalist on Fridays.

Trillions will be invested in 5G, EVs, IoT, energy, and other types of mode…

No one is denying that India has the potential to be a game-changer for the global economy. With 1.25 billion people and growing, India will be the most populous country in the world by 2028. The challenge is that the majority of people in the country are terribly poor (GDP per capita of US$1,500) and that the countrys bureaucracy strangles almost and all business endeavours. That said, there are recenteconomicandbureaucracy reformgreen shoots that show that India could at least temporarily swing out of its funk.

The end result shows the staggering power of compound interest: if India grows at a high rate similar to China over the last decades, India could be a world player in the coming decades. If growth is crippled by bureaucracy and it hovers around 5% on average, India wont become the next China until way in our future: the year 2072.

Commodities: The Top Asset Class of 2018 So Far

This Map Shows the Most Valuable Brand for Each Country

$60 Trillion of World Debt in One Visualization

Thank you!Given email address is already subscribed, thank you!Please provide a valid email address.Please complete the CAPTCHA.Oops. Something went wrong. Please try again later.

The Pension Time Bomb: $400 Trillion by 2050

The third infographic in our Rise of Tesla Series showcases Musks ambitiou…

The Future of Crypto Payments in the Retail Market

How Tech is Changing the Modern Credit Landscape

The world is looking for a new China to be the worlds growth engine. Does India fit the bill?

The U.S. States Most Vulnerable to a Trade War

View the extent of the Warren Buffett Empire in this massive infographic, w…

Ranked: The 10 Wealthiest Countries in the World

The Warren Buffett Empire in One Giant Chart

The Largest Export of Every U.S. State in 2017

What role do independent oil and gas producers play in the energy industry …

There is a staggering amount of plastic debris swirling around our oceans. …

To get off fossil fuels, well need other finite resources such as rare met…

Ranked: The 10 Wealthiest Countries in the World

Why Big Tech is Plotting an Invasion of the Healthcare Market

Growing acceptance of Bitcoin and other crypto hasnt yet translated to eve…

The only problem is that Chinese growth is starting to slow down. To start 2015, the worlds second-biggest economy grew at its slowest pace in six years at a clip of 7.0%, which was down from 7.3% in Q4 2014. Further, the rate of growth in investment, industrial production, and retail sales have been declining consistently over the last four years.

According to the WEF, the retirement savings gap is growing at $28 billion …

The Relationship Between Money and Happiness

View the extent of the Warren Buffett Empire in this massive infographic, w…

The legal cannabis industry is coming out of the dark. Here are 9 things in…

Commodities have kicked off the year as the top performing asset class. Cou…

Chinas Staggering Demand for Commodities

Interactive: Comparing Asian Powers to the U.S.

Finding a new deposit is tough, but heres how to better your odds. This in…

Jeff Desjardins is a founder and editor of Visual Capitalist, a media website that creates and curates visual content on investing and business.

Visualizing Elon Musks Vision for the Future of Tesla

Chart: Americas Gold Plated Cabinet

Largest state exports range from common goods, like autos, planes, and oil,…

Ranked: The 10 Wealthiest Countries in the World

Its not the first time tech has tried to gain a foothold in the healthcare…

In 2017, the Initial Coin Offering (ICO) showed it could disrupt venture ca…

Visualizing Elon Musks Vision for the Future of Tesla

China uses more steel, cement, copper, nickel, and coal than the rest of th…

This Chart Reveals Googles True Dominance Over the Web

The Rise of the ICO, and What It Could Mean for Venture Capital

This interactive map uses 114 metrics to measure the geopolitical power and…

Ranked: The Best and Worst State Economies

Interactive: Comparing Asian Powers to the U.S.

This giant infographic has state economies ranked from best to worst, based…

The Largest Export of Every U.S. State in 2017

The Rise of the ICO, and What It Could Mean for Venture Capital

The Rise of the ICO, and What It Could Mean for Venture Capital

Puerto Ricos Debts Are Not Payable According to Governor

Infographic: What Young People Need to Know About Credit

The third infographic in our Rise of Tesla Series showcases Musks ambitiou…

Visualizing Elon Musks Vision for the Future of Tesla

The Remarkable Early Years of Warren Buffett

The 10 wealthiest countries in the world in 2017 and 2027 (projected):

The Largest Export of Every U.S. State in 2017

We look at how the trade-off of time and money is viewed between different …

How Tech is Changing the Modern Credit Landscape

Histomap: Visualizing the 4,000 Year History of Global Power

Infrastructure Boom: 5 Ways Investors Can Play It

The Relationship Between Money and Happiness

The Warren Buffett Empire in One Giant Chart

The traditional credit score is becoming obsolete – and now, big data and n…

How Tech is Changing the Modern Credit Landscape

In 2017, the Initial Coin Offering (ICO) showed it could disrupt venture ca…

Commodities: The Top Asset Class of 2018 So Far

A Forecast of When Well Run Out of Each Metal

The Pension Time Bomb: $400 Trillion by 2050

Used in everything from autos to appliances, copper is widely watched as an…

$63 Trillion of World Debt in One Visualization

Interactive: Comparing Asian Powers to the U.S.

Visualizing Elon Musks Vision for the Future of Tesla

The Warren Buffett Empire in One Giant Chart

This chart compares the net worth of the initial cabinets of the last three…

The third infographic in our Rise of Tesla Series showcases Musks ambitiou…

China uses more steel, cement, copper, nickel, and coal than the rest of th…

Ranked: The 10 Wealthiest Countries in the World

Why Investors Go to Copper as an Inflation Hedge

9 Things Cannabis Investors Should Know