All this is merely annoying unless you are affected, but hopefully not enough to start the overdue recession.

And limits on visas for certain Chinese nationals.

Basically I think theres many ways to go around this.

However, our pursuit of our individual businesses, which often involves transferring manufacturing and a great deal of engineering out of the country, has hindered our ability to bring innovations to scale at home. Without scaling, we dont just lose jobswe lose our hold on new technologies. Losing the ability to scale will ultimately damage our capacity to innovate.

It was doomed from the beginning. China had planned to send a delegation of about 40 people along with Liu He, sources told theSCMP, but the US government objected, and in the end the delegation was cut to about 10.

I get how China, a major food importer, doesnt want to see food used as weapon. But what do you mean by, it is an option China could use?

Oz was the ONLY US ally to fight in Vietnam.

LEAKED: Trumps Next Shoe to Drop on US-China Trade

Andy Grove was one of the smartest in Berkeley, but his focus is limited ONLY to invention, build wealth and prosperity. That is what he is made of.

To punish China for its intellectual property theft, including IP infringements such as counterfeiting, and to retaliate against Chinese investment rules that require technology transfers to Chinese partners in order to set up shop in China, the Trump administration is considering a proposal by the Office of the US Trade Representative (USTR) that would impose:

The investigation would look into Chinese laws, policies, and practices which may be harming American intellectual property rights, innovation, or technology development.

Liu met with Treasury Secretary Steven Mnuchin, US Trade Representative Robert Lighthizer, and White House economic adviser Gary Cohn, and afterward announced Chinas intention to reduce its trade surplus with the US. According to theSCMP, Chinese state media portrayed Lius mission positively.

A main point made is summarized quite well by the Andy Grove quote above. Why should we subsidize our schools/pay for our kids education/tech development only to then ship it over seas? We pretend / believe that the USA will be an endless fount of creative tech development, independent of whether there is any domestic manufacturing / industry. Clearly this is false. And clearly China is playing a smart game by picking our IP pocket right before our eyes.

Why are Investors in China so Eager to Buy US Homes?

Section 301 of the Trade Act of 1974, as amended, gives the U.S. Trade Representative broad authority to respond to a foreign countrys unfair trade practices. If USTR makes an affirmative determination of actionable conduct, it has the authority to take all appropriate and feasible action to obtain the elimination of the act, policy, or practice, subject to the direction of the President, if any. The statute includes authorization to take any actions that are within the Presidents power with respect to trade in goods or services, or any other area of pertinent relations with the foreign country.

The Chinese yuan or renminbi (CNY), for all the nice words about its internationalization, is allowed to float in a very narrow band against the four currencies the Peoples Bank of China (PBOC) is widely believed to hold in large quantities as their sole foreign currency reserves: the US dollar (USD), the euro (EUR), the yen (JPY) and the British pound (GBP).

Then there was the genius move of exempting ally Canada but not at first, Australia. A little help from State would have helped there (also not consulted)

The USTR also urged US allies, including Japan, to implement similar measures and synchronize their policies, according to the source familiar with international trade, cited by theNikkei Asian Review.

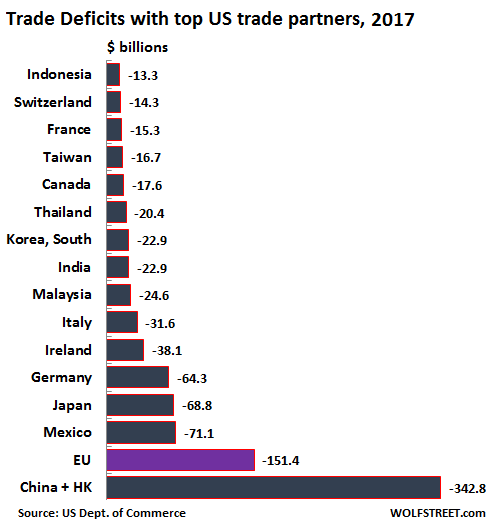

The trade deficit in goods alone was $796 billion in 2017, of which the deficit with China accounted for $342 billion. China exported to the USthree timesas much as it imported from the US.

It was US corporations who lobbied for unfettered free trade and for the right to uproot American industries to whatever state that paid the least. I dont see how you can tar liberals with the broad brush stroke of globalism when it was US corporations and US bankers who wanted protectionist walls torn down and turn capitalism loose.. Well, we got what they wanted and it is we who are paying their price.

For all purposes, however, the renminbi is still if not pegged at very least closely tied to the US dollar: the EUR/CNY exchange rate has been following closely the EUR/USD since at least 2015 and for all those aforementioned nice words about changes in Chinas monetary policies, the PBOC hasnt exactly lost any sleep over the depreciation of the yuan against the euro. More about this in a minute or two.

Nicko2 yep, Canada is going to play ball.

Why are we allowing foreign ownership of anything?

This smells like Ethereums smart contracts i.e. the contract can be smart, but how will it be enforced?

Scaling in the US becomes easier with ribitics and AI to fine time and improve processes.

Sadly, during your days as a free-trade believer, you probably contributed to the decline of American industrial manufacturing through your political and non-political support. I remember conversations with free-trade believers(usually Republicans) who told me that it was an Americans birthright to get the best value for his money, no matter where the product was coming from, and that Americans losing jobs as a result of offshoring can suck it because they were too stupid/lazy/entitled to get a college degree that would get them a real job. And that college degree thing isnt working out too well either, lately, as the flood of H1b visas and BPO/ITES offshoring prove.

In the very end, corporations will learn the price paid for globalism is China has stolen their IP and now competes with them directly, in the free markets.

Also, I thought that after NAFTA passed back in 1995 that Mexico would become equivalent to a 51st state of America. That our ties would become so close and that they would get lifted up economically/socially, etc. etal.

If you consider the advantages, the biggest one China holds today is that it has an authoritarian government that isnt beholden to a two or four year election cycle. The US might have bigger economic guns after a fashion, but it has a glass jaw in the form of voters who have gotten used to having everything delivered to them, and most of those dont have a clue about sacrificing for the greater good because theyve been told that its a pack of lies designed to serve the elites (and there is a good degree of truth to it), tell them that their favorite local coffee shop is going to start serving up $20 lattes because of the increased costs of commodities, theyll cry a hissy fit.

There is no way Canada, Mexico and other countries can replace the US scale as an export destination, not even close.

Have to wonder if Trump is now just getting started on his agenda, after being side tracked fighting the Russian Collusion War for over a year?

Of course, this is now much more difficult than twenty years ago considering how as every talking heads like to say interconnected the world economy is.

The pendulum swings both ways, but there are many moving parts

I think Xis recent success in getting rid of term limits which will allow him to become Dictator for Life can only be detrimental to China progressing further.

We are not just shipping food overseas. We are shipping our topsoil & water overseas in the form of food.

What will this possible trade war do to our agricultural exports to China? Our soybeans are already considered second-rate by China because all the GMO adjustments have lowered the protein content. We no longer control the world in agricultural commodities-Argentina and Brazil will be glad to fill the void. I know, times have changed and farmers are probably 1% of our population. However, there are more farmers than steel workers in this country. If commodity prices drop, then farmers go bankrupt, then China can come in and buy up the farmland for a song. Then who wins?

The thing about trade wars is not so much who wins, but who loses more. In this case, I hate to say that Trump is right, but the US might actually have less to lose in an open tit for tat with China.

I used to be a 100% free trade believer, till I listened to a Vox Day / Stefan Molyneux conversation. Then I bought this book, which was referenced in the conversation. Free Trade Doesnt Work: What Should Replace It and Why by Ian Fletcher.

Rates they knew exactly where the man with the beard was, just like they knew about everything else. And if something isnt there when they need it to be, they just invent it.

You need a constant free flow of ideas and thought for scientific progress and social progress. A repressive government will always hinder ra

How much of the US treasuries do they own? What if they stop buying treasury bonds? can the US support the debt without there buying, or what if they sold a lot? I cant imagine China not doing something from all the tariffs and if this article/leak is true.

Wolf, I think there is a simple truth to the fact that you fight a war when you can win or have a better chance of not losing. For the US, that point might have already passed, it isnt so obvious.

Those who are hoping a Trump trade war will lead to an American industrial revival ought to look at First Solars factory in Toledo, Ohio which is fully automated and underpricing China Where the US is vulnerable is the farm belt.. The last thing China wants is to see food used as a weapon but it is an option that China could use.

To get back to those monetary policies, the EU Trade Commission presently has a growing list of investigations into Chinese and Turkish imports for violating anti-dumping laws. They include a wide range of goods, from solar panels to steel cables, from frozen fish to leather shoes.

Canada has already said they will enact anti-dumping laws.

Californias largest steel company worried it could be harmed by Trumps tariffs

One thing Japan lost out on was the MITI decision to focus on memory instead of microprocessors. At a critical period in tech history the memory market ended up flooded, priced commodity-style, and the high-margin processor market was the place to be. Intel did very well, and even AMD too for quite a while.

If that were to be combined with his proposed 25 cent a gallon increase on gasoline, the stage might be set for GMs next trip to court.

BTW, smart thing I read somewhere several years ago: China is short water, their importing food is akin to their importing water. eg They dont have sufficient clean water to grow the food they need.

Trump probably thinks steel is steel and aluminum is aluminum.

You seem to be ignoring the elephant in the room however with your statement that the industrialists were happy as long as they could make a buck from low wages.the fact that interest rates are RISING after an uncontested 35 year of LOWERING.

So technically, China still is buying US Treasuries, just not increasing its total holdings of Treasuries. Its been my understanding that China has to keep buying US Treasuries and maintain a large horde of US dollars in order to fuel its export economy. US dollars apparently never enter the Chinese economy directly, the central bank of China keeps it walled off from the Chinese companies and issues their own currency to the Chinese companies at the government preferred fixed rates who manufacture and sell their products to US buyers. Because of the huge trade imbalance, China cant help but accumulate a massive horde of US dollars. The US dollar being the worlds reserve currecny means that China can use these dollars to buy stuff it needs from other countries, like oil and gas and other natural products. Still, the US dollars accumulate, and rather than let them sit there, China buys US Treasuries. Apparently if they dont buy US Treasuries, just holding onto massive quantities of US dollars would eventually force their own currency to go up in value.

Starting a trade war with China will surely cure that stubbornly low inflation rate!

I agree. Behind the scenes trade is all negotiated and planned out. What industries to cede, how and who capitalizes on them, how benefits are shared etc. The Trumpian noise we are seeing is just political vaudeville that feels so fresh to those inclined. Reagan raised similar noises v Japan only to bring china in. I have seen such nonsense play out many many times with my own eyes. I dont cream my pants upon hearing it.

And exports are going to start exploding from Canada and Mexico because China will just use those countries to export their goods into the U.S.? Yeah, like that wont stand out like a sore thumb! Probably one of the reasons Canada and Mexico were left exempt of tariffs is because they agreed to keep Chinese dumping out.

But on March 7, after the mission was over, Trumptweeted: The U.S. is acting swiftly on Intellectual Property theft. We cannot allow this to happen as it has for many years! It seems to have been an apt suggestion that the USTRs proposal was on the way. The proposals drastic remedies and the chance that Trump would support them might have been the real reason why Cohn quit, rather than the now softened steel and aluminum tariffs that seemed to be hitting the wrong targets.

I am guessing it is more than 3x. I have read many imports that are banned from China find other routes through shady Mexican or S. American shell companies.

1930s, and one group was characterized as simple, uniform in their thinking, and not complex, with the aim of demonizing them to promote a National (socialist) agenda. In the 1990s, it began again with Rush Limbaugh, this characterization method, of liberals. Always attributing, simple, laughable, lockstep thinking for liberals.

Bill Clinton had done a Super 301 himself ! People will say a lot about these new policies, and patriotism, but US MNCs have reaped BILLIONS from China, truth be told!

This is a rolling mill employing 1000 workers. It imports slabs which it adds value to by reducing them to usable size by feeding them through rollers.

Andrew Grove

I knew from day 1 (nafta) that the free trade meme was bullshit the reason was my father who was a trade and import/export specialist for over 25 years with 13 years working for the department of commerce and was worried for years about trade balance going to shit he would have been driven out on rails had he not been able to retire when he did . All he cared about was what was good for the us economy.

If it sounds like Im being a shill for the guy, Im pointing out the obvious. A leader with will, no checks on him, and the power of the second largest economy in the world is going to ultimately beat the strongest economy in the world where the leaders couldnt get together on something as simple as common sense gun rules or control its own borders properly.

Yes, the stubbornly low inflation rate that created untold trillions of labor arbitrage profits.

Even before that, in the 1970s there was the HK and Japan syndrome with joint ventures, whereupon you would see knock-offs of your product the year after you enjoyed cost savings by outsourcing overseas.

Good comment. I think China has been trying to buy meat producers so they can just cut out the middle man and ship the meat directly to China. Use are Agricultural subsidies to pay for their food. I believe China bought the U.S. and Worlds largest pork producer Smithfield foods.

Sure, China can punish Boeing, Apple, and a bunch of other US companies, agriculture and such, but one has to wonder what China has to lose in turn. Im sure the calculations has been made on this a while ago.

Trump had pledged to crack down on the causes of the huge US trade deficit. In terms of the magnitude of the trade deficit, no countrycomes even close to China(chart shows China and Hong Kong combined due the transshipments via Hong Kong):

Though the USTR has tried to get US allies on board, at least the Japanese government rejected the proposal, saying that it would be difficult to implement since Japan lacks a law similar to Section 301, a US trade official told theNikkei. The official said that Japan had proposed instead a joint suit against China via the WTO. That would make sense to say for Japan; it has only a small trade deficit with China/Hong Kong and in many months atrade surplus.

There are hundreds of companies that will be adversely affected.

Ive heard all of the media decry Xi as an authoritarian, I think he is viewed far more as a patriot in the only place that matters to him. China is using classic strategy of focusing on the weakness of the its biggest rivals and trying to amplify what little leverage it does have to gain advantage, leverage the China market, play off the European business interests against the US, etc, etc. Xi saw what happened to the USSR, he was in the US to see all of the natural advantages the country has. To put it simply, the games that are being played is on a different level as far as China and Xi is concerned, and at different time scales.

Liberals as usual will do their very best to support globalism (labor arbitrage) while ignoring and denying the inconvenient realities.

The pendulum swings both ways but there are many moving parts.

And why are we allowing foreign ownership of farmland?

Made multi-million for Limbaugh, and divided the country into disfunctional sections.

We no longer control the world in agricultural commodities

With the cost of CAPITAL RISING (interest rates)the impetus to replace labor with capital (via productivity) is waning. The RELATIVE increases in the COST of CAPITAL is going to be MUCH GREATER than the relative increase in labor costs in a rising interest rate environmenteven in an inflationary environment.

Would you like to be notified via email when WOLF STREET publishes a new article?Sign up here.

Among the reasons given for opening these investigations (which may lead to punitive import tariffs such as those slapped on cold rolled steel from China and Taiwan; in case you are wondering Taiwan is used merely as a transshipment point for Chinese steel to get around tariffs) are the currency manipulation both China and Turkey engage in with what can only be called thinly veiled enthusiasm.

Restrictions on investment by Chinese companies in the US, the first impact of which we have already seen by Trumps order yesterday blockingall Chinese takeovers of large US tech companies.

These are the most recent data available, data for Q1 2018 should be available in April.

China is far more advanced on robotics and AI than the US. Even with their huge population, and the prospects of them losing jobs, they advance.

This is interesting! but i dont know much about it..but I was wondering how much of the US GDP does China own?

But in August 2017, the USTRannouncedthat it had formally initiated an investigation of China under Section 301:

Whereas comrade Xi has just cemented his power and is now able to reliably ignore any short term pain. If those idiots in Shanghai or Shenzhen want to rise up, fine, confiscate their money and send in the PLA. Whats the west going to do, send in the marines? Whine about it at the UN where China holds veto power? Slap on sanctions that will make the companies cry foul? For every Boeing plane that Xi cancels, he is going to buy something from Airbus, and Airbus is already too tied into China to do anything other than go against any reforms.

Trumps Executive Order blocked not only the $117-billion hostile takeover of Qualcomm, but any substantially equivalent foreign takeover in the future. ReadTrumps Order Stops ALL Foreign Takeovers of Large US Tech Companies

The investigation will seek to determine whether acts, policies, and practices of the Government of China related to technology transfer, intellectual property, and innovation are unreasonable or discriminatory and burden or restrict U.S. commerce.

Interesting correlation with Tillerson being pushed out today. Much of the technology transfer from the USA was to get Japan back into the world trade scene as a player. Patent rulings allowed many US patents for televisions and electronics to be transferred to Japan as manufacturing rights agreements, circumventing patent restrictions. China took this playbook and made into a global deflationary manufacturing strategy to where even Japan had to offshore manufacturing to China. This far-reaching tariff from Trump will put a big hurt on Walmart and the hardware businesses.

I think that trade wars are deflationary if a trade war stifles worldwide sales.

Theres a reason that after two centuries of constant warfare democracies and free societies have emerged triumphant over dictatorships and aristocracies to sit at the very top of the world in terms of living standards and technology.

I warned our business against doing it, only to see the market gutted in a few years in our product category.

What if the whole world didnt have any children for one generation..that would fix it all!

That the Trump administration invoked Section 301 rattled the Chinese government. In February, it sent its top diplomat, Yang Jiechi, to Washington on a fence-mending mission. This resolved nothing. At the beginning of March, it sent President Xi Jinpings top economic adviser, Liu He, for a bigger five-day fence-mending mission.

China has had a trade & economic policy that has been transparent for 30+ years and it was acceptable to industrialists for all of that time as long as they could make a buck from low wages.

Hes using liberals as a bad word which is about all flyover people understand. Its like in intermediate school where if there was that weird person who dressed oddly or was interested in an unusual hobby, they were called a morphodyke.

At some point Trump may offer to pay them in dollars, which may not be as inflationary as you think, because all of those dollars dont come directly back to the US, they are used in Chinas foreign trade exUS. For corporations who have to repatriate the hunt for cheap labor now transitions to robotics, which can live anywhere. China is no longer necessary, just a business deal.

If Trump had listened to his globalist adviser Cohn, (who, on the news, resigned, NOT fired) or anybody who understands a manufacturing ecosystem it wouldnt have happened. There are at least forty US jobs using or processing steel for every one making slab steel.

Good point. Keeping track of all these moving parts that create the global economy is like wrestling with an octopus. Always another tentacle to be mindful of.

An incredible pioneer, business strategist and a wonderful man.

Google Joins Facebook in Crypto Crackdown

LOL. They couldnt even find a man with a beard for 10 years. Heck they couldnt even find those darn Russian conspirators either. The Russians developed new missiles right under our nose and they didnt know about it either. Next youll say school shootings are entirely preventable because the NSA is observing. The NSA is like a boogeyman that always disappoints.

And seriously, just register yourself as a Cayman Island company or something.

Liberals as usual will do their very best to support globalism (labor arbitrage) while ignoring and denying the inconvenient realities.

If auto components are made in China and shipped to Mexico to be installed at a Ford assembly plant, and then the finished car (containing Chinese components) is shipped to the US those Chinese components are reflected in the US-Mexico trade figures, not the US-China trade figures.

The Chinese have essentially stopped buying Treasuries some time ago. Theyre largely just replacing those that mature, and their total holdings have hovered at a little over $1 trillion for a while.

A noble cause! And why should the US taxpayer be subsidizing food being shipped overseas?

With the sophisticated surveillance technology now available to, e.g. NSA, country of origin should be possible to keep track of.

Its a hilarious turn of events. Cutting out the middle-man, why buy anything from these US importers that reaped untold trillions manufacturing offshore when you can buy direct from the offshore factory?

China got handed technology on a silver platter when the greedy U.S. multinationals took their operations there. China would still be back in the Stone Age without it. Trump is turning that ship back around.

Why you tie liberals to globalization is beyond me. That makes no sense. The clear tie is between big corporations and globalization.

Tariffs on a large variety of Chinese products, including tech products and consumer goods like clothing.

If this is true it was leaked by a source familiar with international trade to theand isnt based on a White House announcement then its going to add a lot of fuel to the already heated trade dispute between the US and China, and may ultimately make the steel and aluminum tariffs look like a game.

The probe by the USTR started in August last year, invoking Section 301 of the US Trade Act of 1974. The act, because it conflicts with WTO rules against imposing trade restrictions unilaterally, hasnt been used since 1995, when the WTO began sorting out trade disputes.

now competes with them directly, in the free markets.

Germany, Japan, and other countries have long fumed over the required technology transfers to Chinese partners. At the same time, Chinese companies, often state-owned, have been on a shopping spree in Germany, going after robotics know-how and other industries, which has caused a lot of soul-searching in the business community in Germany. Japan too has long opposed Chinas intellectual property practices, as theNikkeiput it. Now the USTR has asked these countries to do something about it.

But I think the idea is that the implementation of the proposal would shake up China, and cause China to change in a way that it shrinks the trade gap and solves the IP issues, the technology transfer requirements, etc. That would be the best outcome.

One way of looking at this questions as to who will lose more if it comes to a trade war: the Chinese export 3x as much to the US than what the US exports to China. So in that sense, its going to hurt China 3x as much. Obviously, the US-China trade relationship is a lot more complex. US corporate supply chains go all over China. So if it comes to a trade war, its going to be a big mess.

That could be true. I always add China and Hong Kong together in all trade figures since a lot of the merchandise is transshipped via HK.

Regarding US debt. According to the US Treasury Department (Treasury), at 31 December 2017 China as a whole (Treasury doesnt break up foreign holders of securities in governments, individuals, banks etc) held US$ 1184.9 billion, up from US$ 1058.8 billion on 31 December 2016 and allowing China to muscle Japan back in second place in this questionable list. Intriguingly enough over the same time frame Japan actually scaled back their treasury holdings a tiny bit: about $30 billion 🙂

Watch this Jimmy Kimmel segment. If you think Trump has any agenda other than helping himself, his family, his friends and associates to feed at the trough, youre living in a fools paradise.

Whats going on in politics is about game theory, control, sabotage, power grab. The goal is NOT about wealth and prosperity although they may need to deal with it in order to reach their true goal of dominance, both domestically and globally. Very different goal, game and what AG says, although noble and beneficial to the society, he will NOT survive the political game let alone winning it like the Trumps and Clintons.

Well, the globalists can (will) always turn around and ask Uncle Sam for assistance (no tax, subsidies, etc.). Look at Amazon, city officials are stepping on one another to offer it the moon.

No mention is made of the fact EU firms have been outsourcing in both China and Turkey with not so much veiled enthusiasm, taking advantage of those same conditions the Trade Commission may consider a cause for tariffs.

There are hundreds of varieties of each. Hershey wraps its chocolates in a very special thin foil. No US mill makes it or is likely to.

In Groves 2010 Bloomberg essay, he also saw scaling as a major issue:

But if he tears into NAFTA, especially the totally integrated auto sector, look out below.

Canadian, Mexican and other countries export will explode because China will just export vis a vis those countries.

Andrew Grove, the founder of Intel, was especially worried about lost jobs and lost expertise from offshoring.

Now I read they are trying to use Smithfield foods to buy chicken and beef producers.

Many people actually DID see what was going on and they did speak up about the hollowing out of the country. Its just that the globalists were in control and they crushed all dissent. Ross Perot was right there was a giant sucking sound.